Methodology

Smart Beta Strategy

Equal-weight Allocation

Semi-annual Rebalancing

Principled Inclusion

Disciplined Approach

Diversified Composition

Basis for Investment

Emerging Asset Class

Diversification Potential

Alphabyte Capital is an investment management firm specializing in the development and management of active and passive strategies of alternative and digital assets.

Equal-weight Allocation

Semi-annual Rebalancing

Disciplined Approach

Diversified Composition

Emerging Asset Class

Diversification Potential

© 2023 αbc | AlphaByte Capital. All rights reserved.

| Aave | Algorand | Aptos | Arbitrum | Avalanche | Balancer | Bitcoin | Cardano | Chainlink | Chia | Compound | Cosmos | Curve DAO Token| Decentraland | Ethereum | Fantom | Filecoin | The Graph | Herdera | Helium | Internet Computer | Lido DAO | Litecoin | Maker | Mina | Monero | MultiverseX | NEAR Protocol | Polkadot | Polygon | Quant | The Sandbox | Solana | Synthetix | Tezos | Uniswap | Waves | XRP | Yearn.Finance | Zcash |

Purpose

The Byte Index serves as the benchmark for investors and managers regarding the performance of the digital-asset market. The Index captures the general sentiment of the market and creates a basis for investment into the market.

In addition, the Byte Index serves as an ex-post performance indicator and as a proxy for asset allocations. Over time, the Index provides investors and managers a tool to measure ex-ante return, risk, and correlation of the market.

Principles

Asset inclusion will be discretionary and both qualitative and quantitative measurements will be considered for the index construction. These include:

Special Situations

Hard Forks – A minimum of 3-month period before a digital asset from a hard fork will be considered for inclusion into the index. Newly hard-forked digital-assets will be distributed to investors in a timely manner.

ICOs/STOs – A minimum of 3-month period before a digital asset from a(n) ICO/STO will be considered for inclusion into the Index.

Weighting

Equal-weighting has the potential to outperform traditional weightings in the long term. Reasons include:

Maintenance

Semi-annual rebalance on the third Saturday of January and July at 00:00 AM GMT. The index is representative of the overall digital asset economy and will adjust its inclusions based on analysis and committee recommendations to assure meaningful, relevant, and comprehensive coverage.

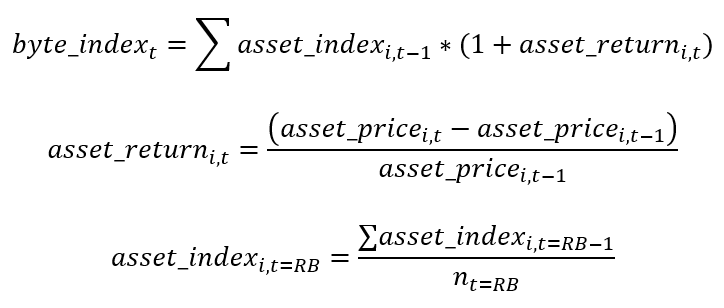

Calculation